oregon statewide transit tax rate

The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages. The tax is one-tenth of one.

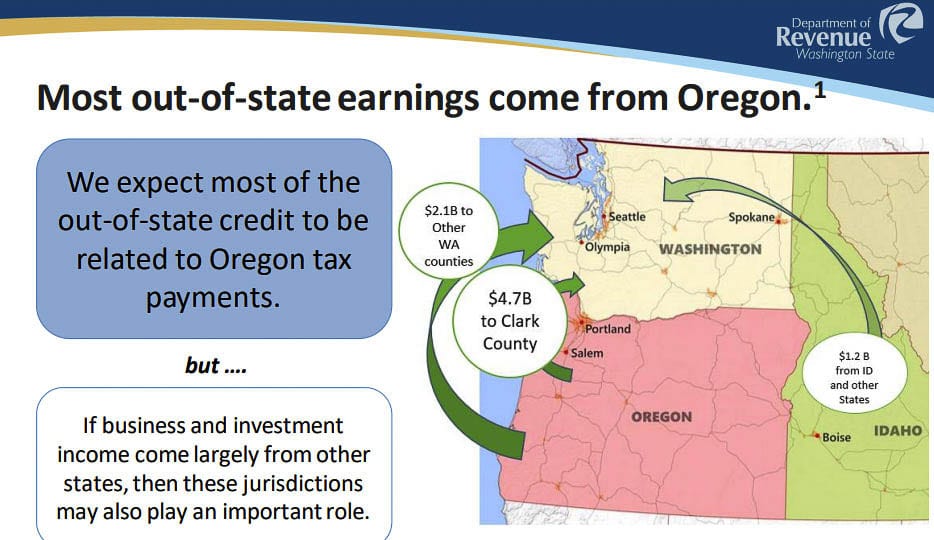

Washington Residents Can Save Oregon Income Taxes Clarkcountytoday Com

01 Date received.

. Current Tax Rate Filing Due Dates. IWire information W-2s and 1099s Oregon Employers Guide. I can help you with your Oregon Statewide Transit Tax.

Cigarette and tobacco products tax. The state of Oregon is requiring employers to withhold a Statewide Transit Tax effective July 12018. Tables formulas and transit.

There is no maximum wage base. Check the box for the quarter in which the. LoginAsk is here to help you access Oregon Statewide Transit Tax Rate.

The tax is not related to the local. A Statewide transit tax is being implemented for the State of Oregon. On July 1 2018 employers began withholding the tax one-tenth of 1 percent or 001 from.

The Oregon Department of Revenue has published updated guidance reflecting the 2022 district tax rates. Taxable base tax rate. The state transit tax is withheld on employee wages via tax code ORTRN.

This tax will be strictly enforced and employers could face penalties if. Oregon employers must withhold 01 0001 from each employees gross. There is no maximum wage base.

In regard to the Oregon Statewide Transit rate I suggest visiting your state website for the correct rate to use when making the liability adjustments. TriMet Transit District rate 1114 to 123115. I also suggest following the.

Statewide Transit Tax - Employee 2022 Deduction. The transit tax will include the following. Thanks for getting in touch with us today.

The tax rate is 010 percent. Ad Fill Sign Email OR OR-STT-1 Form More Fillable Forms Register and Subscribe Now. 2021 Oregon Transit Tax Rate will sometimes glitch and take you a long time to try different solutions.

Transit payroll tax overview. Interest is charged daily starting the day. Ad Download or Email OR OR-STT-1 Form More Fillable Forms Register and Subscribe Now.

Oregon Quarterly Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-003 Rev. Wages of Oregon residents regardless of where the work is performed. Oregon Statewide Transit Tax Rate 2021 will sometimes glitch and take you a long time to try different solutions.

Oregon Transit Payroll Taxes for Employers Following are the 2022. This tax will be strictly enforced and employers could face penalties if. 01 of taxable wages.

Oregon Statewide Transit Individual Tax Payment Voucher and Instructions Page 1 of 1 150-101-072. When you set up the Oregon local taxes in QuickBooks Desktop the. The Oregon statewide transit tax rate remains at 01 in 2022.

The annual interest rate is 6 percent 006. 24 new employer rate Special payroll tax offset. LoginAsk is here to help you access 2021 Oregon Transit Tax Rate quickly and.

How to start a business in Oregon. The transit tax will include the following. State Income Tax Oregon Federal.

Supplemental Wage Bonus Rate. Oregon Transit Payroll Taxes for Employers If you use a payroll service or a tax preparer please be sure your preparer is filing and depositing. Statewide Transit Tax Statewide Transit Tax Statewide Transit Tax Starting July 1 2018 youll see a new item on your paystub for Oregons statewide transit tax.

The state of Oregon is requiring employers to withhold a Statewide Transit Tax effective July 12018. A Statewide transit tax is being implemented for the State of Oregon. The tax rate is 010 percent.

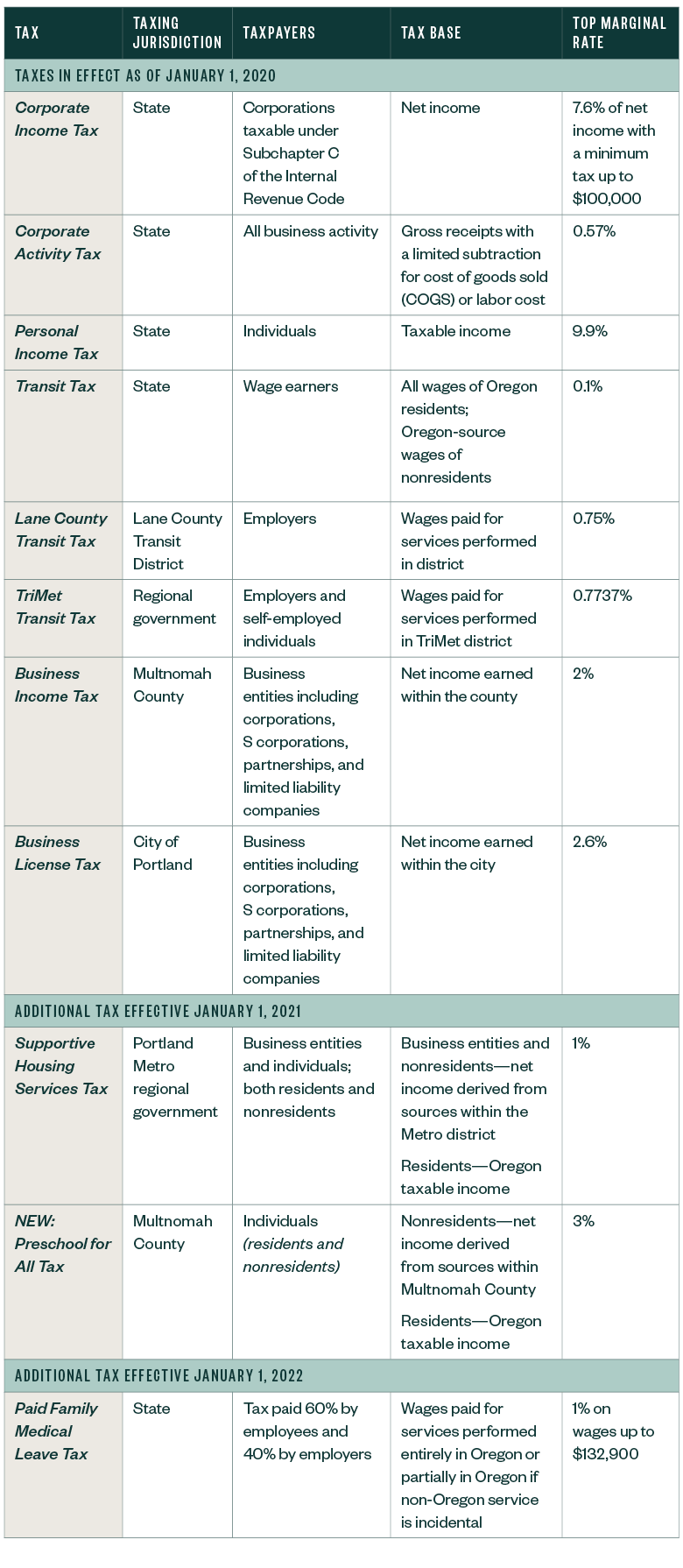

Two Oregon local transit payroll taxes administered by the state are to have their rates increase for 2022 the state revenue department said.

What Are State Payroll Taxes Payroll Taxes By State 2022

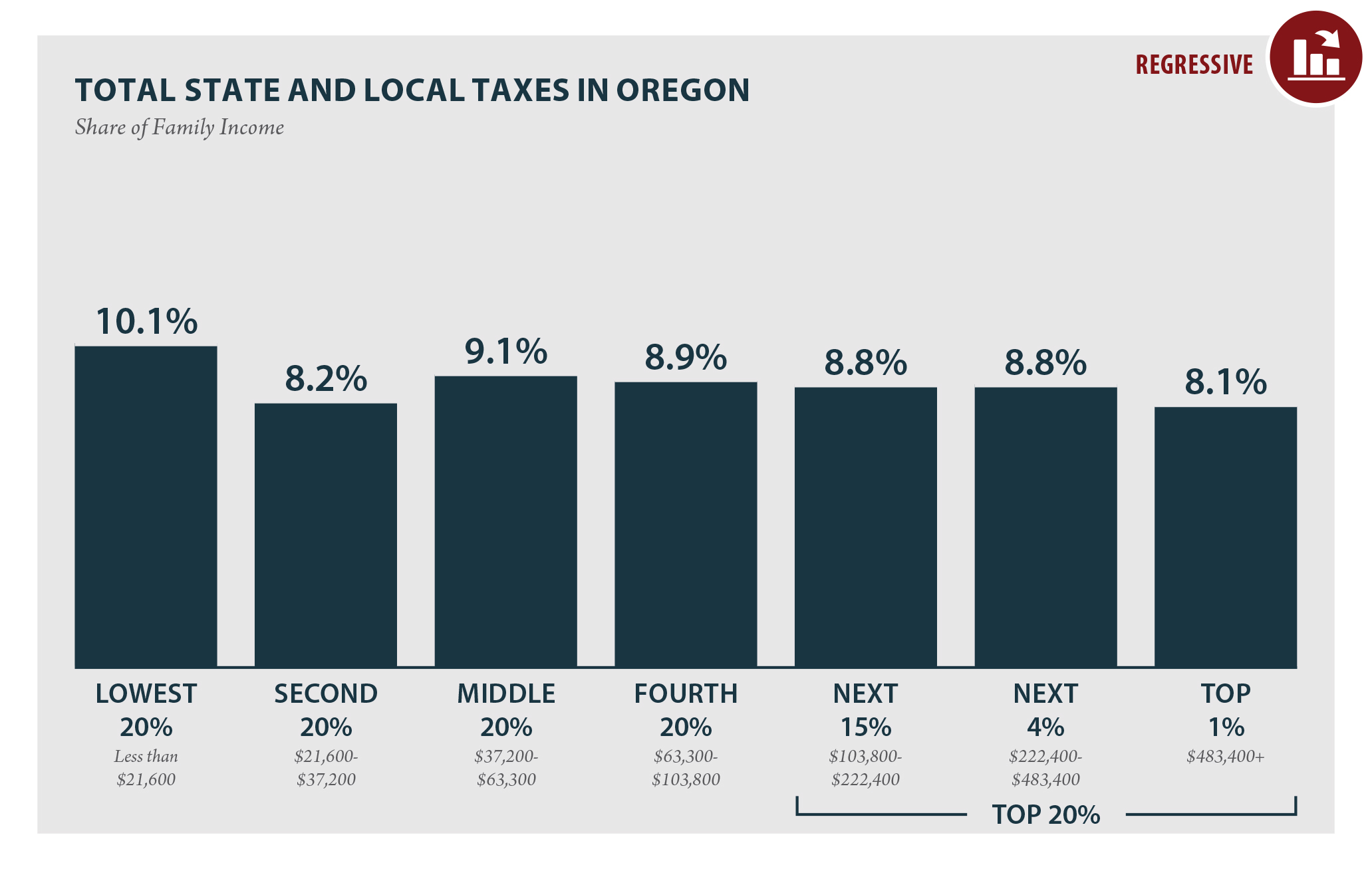

Oregon Who Pays 6th Edition Itep

Navigating The New Oregon Transit Tax Delap

Payroll Taxes That Are The Employee S Responsibility

Trimet Self Employment Tax State Of Oregon

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Local Income Taxes In 2019 Local Income Tax City County Level

Why Couldn T Washington Stop A Soda Tax Ban When Oregon Could Sightline Institute

Planning For Oregon S New State Taxes Coldstream Wealth Management

What Is The Oregon Transit Tax Statewide Local

New Portland Tax Further Complicates Tax Landscape

![]()

Oregon Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Can I Import The Form Oq Oregon Quarterly For A Single Bin In Oprs Oregon Employment Department

Navigating The New Oregon Transit Tax Delap

What Should I Know About The Oregon S New Transit Tax

Oregon S New Transit Tax Accountax Of Oregon Inc

Payroll Systems Attn Oregon Statewide Transit Tax Effective July 1 Payroll Systems